Explain the Reason for Any Difference in the Ending Inventory

The lower-of-cost-or-market rule requires a company to ________. Explain the reason of difference in net operating income if any under two approaches.

Methods Of Estimating Inventory Accountingcoach

A discrepancy in inventory stock is when the actualstock in a warehouse of a retail store does not match the recorded inventory stock count.

. And it keeps track of the cost of goods purchased and sold. Your choice can lead to drastic differences in the cost of goods sold net income and ending inventory. Explain the difference in ending inventory values Answered.

Ending inventory Beginning Inventory Monthly Sales12-Month Average Monthly Sales Profit12-Month Average Profit. Try Sortly Free for Two Weeks. These drive up costs.

You Need Something to Work. Inventory may arrive at the receiving dock during a physical count so you include it in the count. However usually only very very few parts in your inventory are currently worked on.

There are advantages and disadvantages of each method. The ending inventory absorbs a portion of fixed manufacturing overhead and reduces the burden of the current period. Explain the reason for any difference in the ending Assignment Help Accounting Basics.

The company has just opened a new plant to manufacture the antenna and the following cost and revenue data have been provided for the first month of the plants operation in the form of a worksheet. Explain the reason for any difference in the ending Wiengot Inc produces and sells a unique type of TV antenna. Use the LIFO method in times of rising price.

Determine the unit product costb. The difference between absorption costing vs variable costing methods pertains mainly to the allocation of fixed manufacturing costs. Prepare two income statements one using variable costing method and one using absorption costing method.

Shrinkage a leading cause of discrepancy in your inventory stock accounts for on average over one percent of total retail sales. Get solutions Get solutions. Prepare a contribution format income statement for the month3.

Assume that the company uses variable costinga. Shrinkage occurs through such means as clerical errors shoplifting employee theft and supplier fraud. Adjust the cost of goods sold downward if the inventorys replacement cost is lower than its historical cost.

Perpetual inventory continuously tracks and records items as they are added to or subtracted from the inventory. Learn more about the dangers of inventory shrinkage. Adjust the inventory balance downward if its replacement cost is lower than its historical cost.

This difference is because of fixed manufacturing overhead that becomes the part of ending inventory under absorption costing system. You actually have to have a part if you want to work on a part. Ending inventory Beginning Inventory Monthly Sales2 Average Monthly Sales - Profit2 Average Profit.

Explain the reason for any difference in the ending inventory balances under the two costing methods and the impact of this difference on reported net operating income. If youre trying to minimize your end inventory you might use a formula like this. 3 Explain the reason for any difference in the ending inventory balances under.

For tracking it is important for you to know when the vendor is shipping inventory and when it will arrive. At a bare-bone minimum the part you are working on needs to be there. Computation of units in ending inventory.

Without adequate inventory management youll pay your employees to spend time sifting through files sending spreadsheets to one another manually write all reports or visit the warehouse every time theres uncertainty. 3 explain the reason for any difference in the ending. Solution 1 Income statements a.

For example the LIFO method will give you the lowest profit because the last inventory items bought are usually the most expensive while the FIFO will give you the highest profit as the first items in stock are. Explain the reason for any difference in the ending inventory balances under the two costing methods and the impact of this difference on reported. Physical inventory uses a periodic schedule to manually count and record items and keep track of the cost of whats bought and sold.

3 Explain the reason for any difference in the ending inventory balances under from AC 222 at Boston University. Both absorption and variable cost methods are based on the accrual concept of accounting. The opening inventory was 2000 units.

The company has just opened a new plant to manufacture the antenna and the following cost and revenue data have been provided for the first month of the plants. Customers may have some of their inventory at your location so you may mistakenly count it as though it is your own inventory. Explain difference in the ending inventory balances Assignment Help Financial Accounting.

Inventory management is a crucial function for any product-oriented business. Late delivery due to stock-outs is bound to give you a bad reputation. Explain any difference in the ending inventory balances Answered.

For instance if a Borders Bookstore inventory stock. This brings me to the second reason why you need inventory. You may have inventory on consignment at retailers and forget to count it.

Wiengot Inc produces and sells a unique type of TV antenna. Any discrepancy between a companys actual ending inventory versus whats listed in its automated system may be due to shrinkage a loss of inventory for any number of reasons including theft. As a result they pose a difference in the value of inventory consequently affecting the reporting of operating income.

Employee efficiency can significantly increase your businesss overall health. First in first out FIFO and last in first out LIFO are two common methods of inventory valuation for businesses. Lack of the right inventory at the right time can mean back orders excess inventory etc.

Methods Of Estimating Inventory Accountingcoach

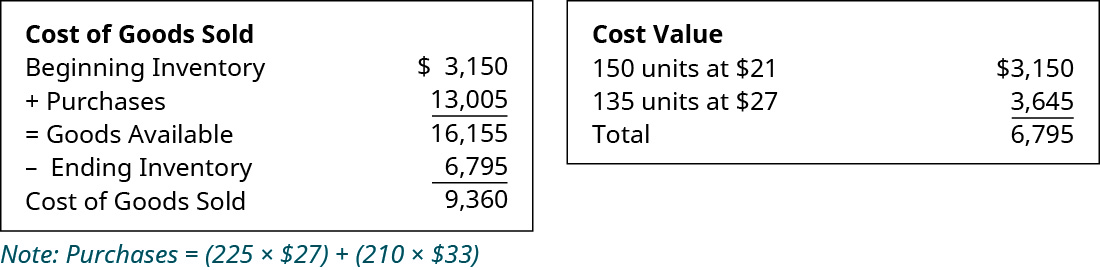

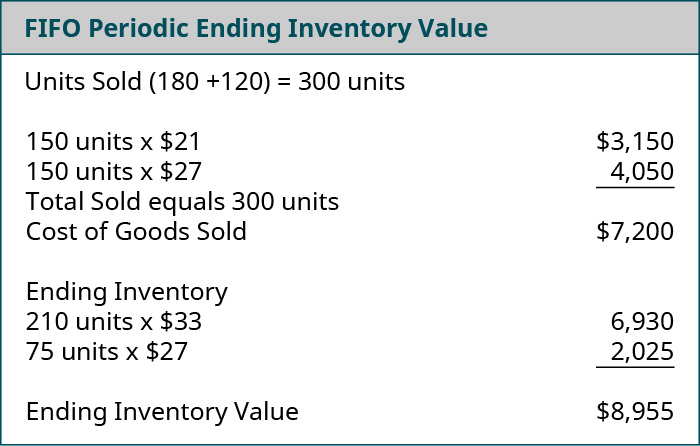

Calculate The Cost Of Goods Sold And Ending Inventory Using The Periodic Method Principles Of Accounting Volume 1 Financial Accounting

Calculate The Cost Of Goods Sold And Ending Inventory Using The Periodic Method Principles Of Accounting Volume 1 Financial Accounting

Comments

Post a Comment